The less time you spend on things other than practicing law, the better.

You should definitely not be doing your own bookkeeping.

Unless you’re also a Ninja-class CPA with lots of free time.

Or a glutton for punishment.

But apparently…

Some lawyers are gluttons for punishment.

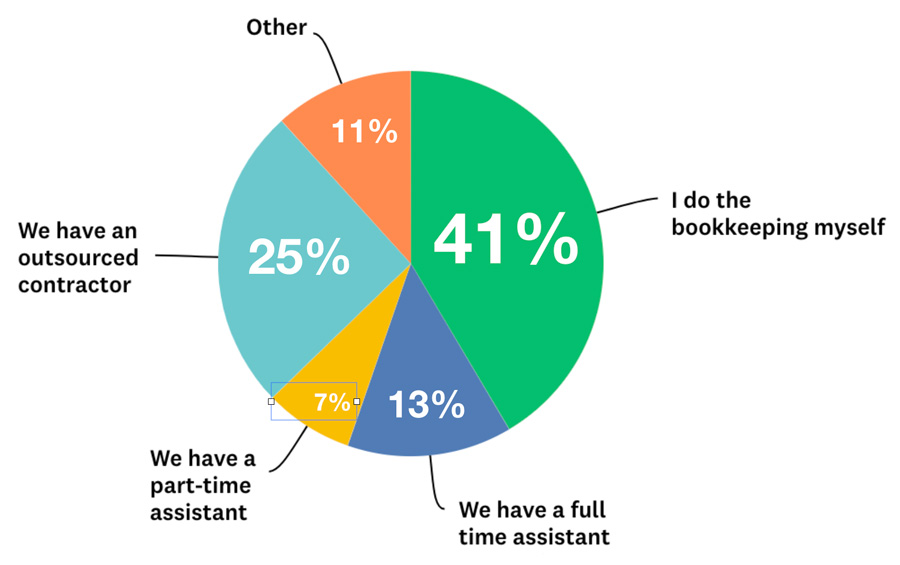

A few weeks ago I sent out a survey asking lawyers how they handle bookkeeping in their firms.

The results were surprising. 41% of the respondents said they do their own bookkeeping.

This to me is crazy.

Why would any lawyer want to spend time on this kind of tedious work?

Especially when there are services out there to whom you can outsource your law firm’s bookkeeping.

Introducing Kahuna Accounting

You should check out Kahuna Accounting.

They know all too well the challenges that solo and small firm lawyers face. For example, things like:

- Your practice management, accounting and bank accounts are all different

- The financials you see are completely meaningless to your goals

- Preparing your taxes is an excruciating nightmare

- You’re wasting precious time doing tedious data entry

As they explain on their website, after you hire them they have a 3 step process:

- They clean up your financials so you’ll know exactly how much money you’re making, and how well your firm is doing

- They’ll take over the day-to-day bookkeeping and making ongoing assessments about how you can improve

- They’ll set up reporting and dashboards focused on cashflow, growth and profit.

Lawyers LOVE Kahuna

All the lawyers I know that use Kahuna swear by it.

I asked my friend Keith Magness to explain how it helped him, and this is what he told me:

“Kahuna is absolutely great. Once you get past the initial on-boarding process it’s like bookkeeping on autopilot.

Every now and then I’ll get an email with a specific question of how to classify a charge. But otherwise, my accounts are reconciled almost daily.

They even record the date/time of my monthly IOLTA reconciliation to comply with the new Rule of Professional Conduct. Keith elaborated with greater detail the most recent time I asked him:

“Before I used Kahuna, bookkeeping entries were input locally in the office using QuickBooks Online either by a support staffer, or, worse yet and most often, myself.

Each month I would have to print reports from my timekeeping system (Clio) to send to my CPA who would then compare the data in QuickBooks Online and make journal entries to fix all of our mistakes.

This entire process would require at least two to three days of attention from me each month. Time usually spent on weekends as I have client work to do during the week.

Now, with Kahuna, I’ve switched to Xero which integrates seamlessly with Clio. While I still have to write checks (Kahuna is virtual), this is done using Xero so the transaction data is captured at the creation point.

Kahuna then monitors all my business accounts (Operating, IOLTA, credit card, etc.) via bank feed or “bookkeeper” access, and makes and reconciles the entries. Other than an occasional email from Kahuna seeking guidance as to the purpose of a particular credit card charge, I don’t touch a thing. Rather, I simply review reports generated by Xero to ensure the ship is running well.

Kahuna even creates date stamped reports on a monthly basis in connection with reconciliation of my IOLTA account. This way I’m sure to avoid any violations of the new bar rule requiring proof that you reconcile your IOLTA account at a minimum on a quarterly basis.

For an additional fee (depends upon the average number of transactions per month), Kahuna will even issue checks to vendors.

I do not utilize this service as most of my vendors accept payment via credit card or EFT. But if my check volume ever gets up there, I may explore this service.

All I would have to do is load the bill info into Xero as a bill to be paid (just like I do now), note the due date, and they cut the check and post the payment so it arrives on time.

To do this, you just have to have a signature stamp created and send it to them in Illinois.” So there you have it, straight from a once-overworked lawyer’s mouth.

If you’re one of the 41%

If you’re doing your own bookkeeping, perhaps you should consider Kahuna.

I started using them for my business about 6 months ago.

I knew my bookkeeping was a mess, and I dreaded what they might find.

But my dread turned to joy when they told me they discovered that in the past three years I’d overpaid taxes by about $50,000.

I sent the information that Kahuna unearthed to my accountant and now I’m $50,000 richer.

Obviously, I can’t promise that they’ll find you massive amounts of lost money.

But I can guarantee Kahuna will make your life a whole LOT easier.

P.S. Get the Smart Lawyers Tech Guide.